Beliefs Drive Behavior. We Help you turn that truth into growth.

95% of purchasing decisions are driven by core consumer beliefs*

Harvard Business Review, 2023

Behind every choice is a belief about

what matters most.

We help you uncover those beliefs and turn them into experiences that move people.

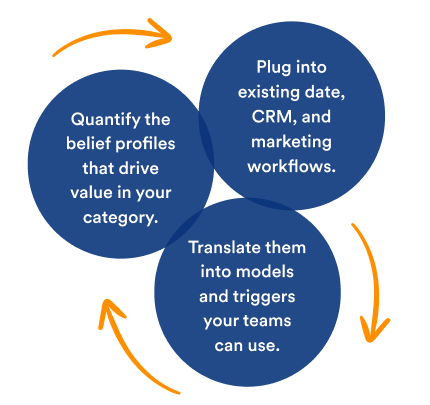

We pinpoint the belief profiles that drive choice in your category, quantify their value within your customer base, and translate them into actionable intelligence. Then we embed those insights inside your existing systems, as prioritization rules, activation triggers, and journey logic, so you can shape behavior, not just measure it.

Before you ever go live, we test experiences using AI agents modeled on real belief profiles, simulating audience reactions, refining creative, and accelerating what works.

Trusted by Leaders across categories to turn insight into advantage

When a top financial services company needed to spur growth, we used our Investor Persona model to focus targeting, redesign their customer experience, and ultimately drive growth.

What do your

customers believe?

Contact us and we will share the belief insights we have developed in your sector and how they have helped organizations attract, convert, and retain more of their most valuable customers.

If the approach resonates, we can prove its impact in your own data within 60 days.

See customer value mix

Which customers you’re truly winning, how much value your acquisition add, and where customer beliefs patterns uncover untapped value.

Prove what works fast

Test high-value belief profiles, launch quick-win campaigns, and optimize journeys in real time.

Scale with Confidence

Turn proven moves into a practical playbook that delivers results, accelerates growth, and runs on the tools you already have.

Schedule a 30-minute briefing on the beliefs driving choice in your category.