Healthcare: What If We’ve Been Solving the Wrong Problem?

The U.S. healthcare system is the most expensive in the world and yet consistently underperforms on outcomes, equity, and engagement. Billions have been spent trying to fix access, optimize operations, and improve quality. And still, too many people delay care, drop out of programs, or ignore advice that could extend or improve their lives. Across all segments: Medicaid, Medicare Advantage, commercial, and employer, one persistent challenge remains: people just don’t always act in their own best interest.

Our belief is that outcomes and efficiency don’t just depend on care quality or systems design, but on emotional resonance, because while logic drives consideration, emotions drive action.

Healthcare experiences must be built to shape behavior, not just reflect it.

The Strategic Blind Spot in Healthcare

Healthcare systems are rich in data, and some have begun to segment by values or attitudes. But even with that progress, most remain blind to member motivation in a way that drives action.

Risk scores, demographics, and utilization history are all useful. But they don’t explain why someone skips a screening, delays a follow-up, or never logs into a portal. They tell us what happened with a member, not what matters to the member.

This is the missing layer: understanding, and designing for, what people need to feel before they act.

It’s not that the current tools are wrong. It’s that they’re incomplete. Personal motivation and the core beliefs that drive trust, action, and change, has been left out of the equation.

We’ve seen this blind spot before, across health, wellness, and financial services: this gap between what systems know and what people need to feel before they act. Most systems have treated motivation as noise, too soft, too messy, too hard to scale. But our work shows it’s not only measurable and scalable; it’s predictable. And when you design around it, engagement changes, so do outcomes, and so does efficiency.

Our belief-based model closes that gap. It decodes emotional posture, classifies motivational segments, and enables systems to design experiences that move people, not by pushing harder, but by aligning with how they already think, feel, and decide.

In every domain, the pattern holds: when belief is ignored, engagement stalls. When it’s understood and honored, behavior shifts, consistently, and at scale.

Where Emotion Meets Complexity: High-Consideration Decisions

We’ve applied this belief-based model across industries where people face emotionally and cognitively demanding decisions:

- In health and wellness, where motivation often collides with fear, shame, or uncertainty

- In financial services, where identity, trust, and confidence shape key behaviors

- And now in healthcare, where the stakes are highest, but engagement is often shallow

Whatever the context, the barriers to action are strikingly similar:

- Is this really for me?

- Do I trust this?

- What will this say about me?

- Will I still be in control?

In each domain, we develop personas grounded in belief systems, internal frameworks that shape how people interpret, trust, and decide. In healthcare, for example, we identify belief-based groups like Proactive Health Managers, Aspirational Improvers, Event Triggers Reactors, and Non-Engagers.

These personas aren’t attitudinal fluff. They’re predictive tools that drive strategy across sectors, across platforms, and across outcomes.

Belief Before Behavior

In high-stakes decisions, logic informs, but emotion moves. That’s why belief-aligned design begins with what people must feel to act.

- For a Proactive Health Manager, the experience must reinforce autonomy and competence. Lead with empowerment, results, and long-term payoff.

- For an Aspirational Improver, the tone should be supportive and motivational. Focus on progress, potential, and belonging.

- For an Event Triggers Reactor, outreach should be timed, reassuring, and practical – framed as a solution to a specific disruption or concern.

- For a Non-Engager, simplicity, low pressure, and trust-building matter most. The goal is to remove resistance, not push action.

These are not abstract insights. We’ve operationalized this logic in:

- Navigator scripts, adapted by persona

- Digital UX variants, sequenced to align with emotional readiness

- Outreach flows, where channel, frequency, and tone are calibrated to motivation

- CDP segmentation and AI pipelines, that classify and route leads or members in real-time

The result? Higher initial activation. Lower friction. And journeys that feel personal—because they are emotionally precise.

Applying the Model

- Wellness Programs: Campaigns tailored to motivational segments led to a 30% lift in content engagement and sustained participation over 60 days

- Chronic Care Management: Messaging framed around control and independence improved speed to next action by 40% in key personas

- Financial Services: Belief-based segmentation reduced drop-off in complex decision journeys by over 25% and increased conversion velocity

What We Changed

- Motivational alignment → Higher initial engagement and fewer abandoned sessions

- Segment-specific content design and sequencing → Increased sustained interaction and program completion

- Tone and emotional framing → Greater trust and self-reported clarity in high-stakes decisions

Closing the Belief–Action Gap

Healthcare doesn’t have a messaging problem. Or an access problem. Or a tech problem. It has a motivation problem, and it shows up in every missed screening, dropped onboarding, and unengaged member.

At Rosemark, we’ve developed a belief-based approach that uncovers the causal connection between belief and behavior, and scales that insight across journeys, scripts, and digital tools. Our model classifies individuals into actionable belief-based personas, and we’ve implemented this system across health, wellness, and financial services. The results speak for themselves: faster activation, deeper participation, and measurable impact, without adding friction.

Now, we’re helping healthcare organizations build this emotional infrastructure into their core operations.

If you’re trying to:

- Boost early activation and sustained participation in high-value programs

- Improve Stars, HEDIS, and CAHPS scores through motivation-aligned engagement

- Accelerate member decision-making on plan choice, provider selection, or benefit use

- Re-engage passive or hard-to-reach members with belief-aligned messaging

- Match members to the right care pathway based on emotional readiness and intent

- Reduce friction in navigation and increase trust in digital or human support channels

- Improve cost efficiency by focusing resources on interventions more likely to convert

We would be happy to explore with you how belief-based design can drive better outcomes for your organization and the people you serve.

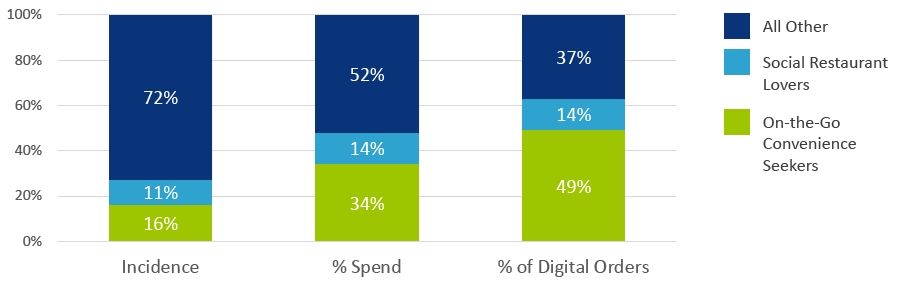

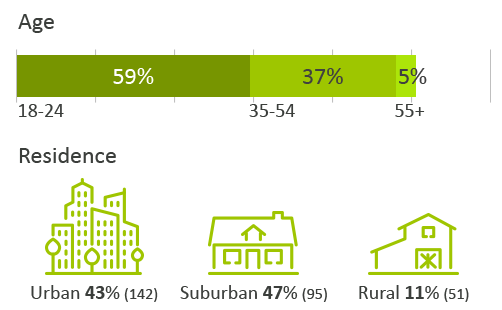

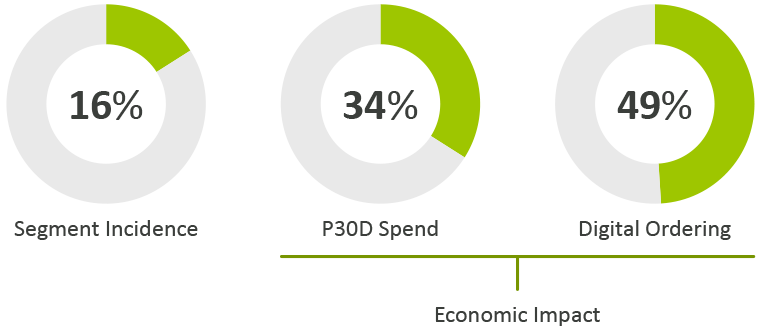

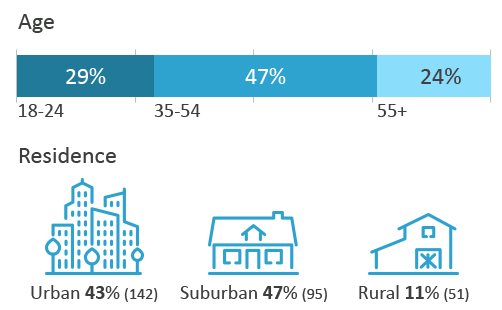

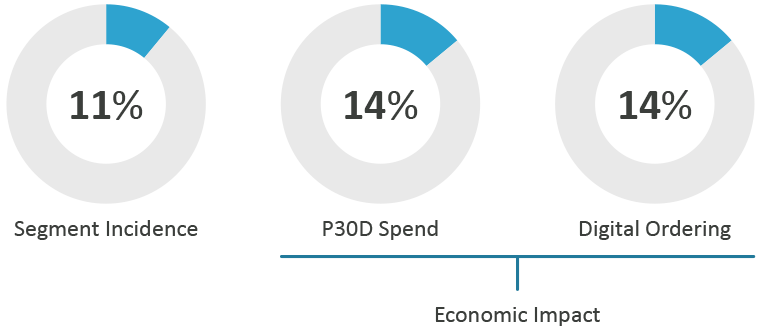

These 2 target QP Clusters not only represent significant opportunity for restaurant brands due to their volume, but they have unique motivations and preferences that drive their outsize volume and digital ordering. Restaurant brands that can personalize their digital ordering experience and marketing communications to these target QPs to drive greater share of meal occasions and greater volume. The On-the-Go Convenience Seeker QP Cluster are the highest value consumers whose busy lifestyle and preference to eat out vs cooking at home drive their behavior of eating out nearly 40 times per month. They have a high preference for digital ordering and they spread their meal occasions across up to 14 different restaurants per month.

These 2 target QP Clusters not only represent significant opportunity for restaurant brands due to their volume, but they have unique motivations and preferences that drive their outsize volume and digital ordering. Restaurant brands that can personalize their digital ordering experience and marketing communications to these target QPs to drive greater share of meal occasions and greater volume. The On-the-Go Convenience Seeker QP Cluster are the highest value consumers whose busy lifestyle and preference to eat out vs cooking at home drive their behavior of eating out nearly 40 times per month. They have a high preference for digital ordering and they spread their meal occasions across up to 14 different restaurants per month.

The Social Restaurant Lover QP Cluster are the highest engaged dining consumers. They are actively engaged in loyalty programs and expect frequent updates from their favorite restaurants. They view dining out as an opportunity to socialize with co-workers, friends and family.

The Social Restaurant Lover QP Cluster are the highest engaged dining consumers. They are actively engaged in loyalty programs and expect frequent updates from their favorite restaurants. They view dining out as an opportunity to socialize with co-workers, friends and family.

Rosemark is partnering with leading marketing services and technology companies to implement QP-based personalization with their dining clients. We look forward to sharing more information on the Rosemark Dining Category Quantitative Persona Structure and identifying opportunities to apply the QP Method to other categories,

Rosemark is partnering with leading marketing services and technology companies to implement QP-based personalization with their dining clients. We look forward to sharing more information on the Rosemark Dining Category Quantitative Persona Structure and identifying opportunities to apply the QP Method to other categories,